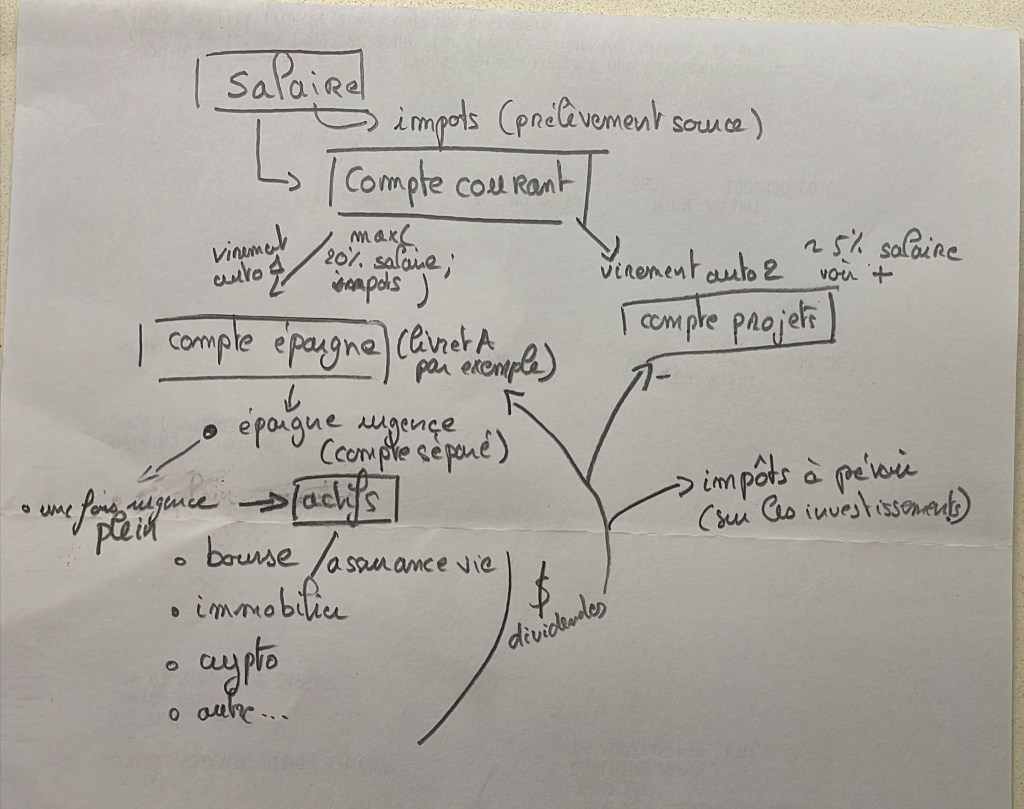

Cet article est la suite logique du systeme elabore dans un post precedent: https://personaloptimum.com/2022/12/30/plan-dattaque-partie-1-la-mise-en-place/

L’ordre de la séquence est important; bien entendu rien ne vous empêche de commencer par cet article, ou de lire les deux en parallèle. Néanmoins je vous encourage fortement à vous intéresser premièrement au système avant de passer du temps sur les investissements à proprement parler.

L’épargne d’urgence

Compte aussi liquide que possible. Le but de ce compte n’est pas de générer des revenus mais d’être disponible à n’importe quel moment, sans avoir besoin de vendre des actifs.

C’est donc typiquement un support sans risque et sans engagement de durée.

Le livret A peut faire l’affaire, ou n’importe quel compte sans risque.

Il est important que ce compte soit ouvert avec une autre banque que celle ou vous détenez votre compte courant du quotidien. Pourquoi? Afin d’éviter la tentation de piocher dans ce compte pour des dépenses imprévues mais néanmoins superflues (weekend, shopping, achats conséquents…)

Pour ce qui est du montant adapté, 3 à 6 mois de budget (mensualités de remboursements de prêts incluses) me semble être un matelas adapté.

Ne passez à la suite qu’une fois votre épargne d’urgence mise en place.

L’épargne long terme

C’est là que les choses deviennent intéressantes. La première idée est de sortir de la recherche du portefeuille d’investissement parfait. Cette quête sans fin est un frein réel à votre succès car elle repousse votre lancement dans l’investissement. Et quand on parle d’investissement long terme, le facteur temps est souvent la variable la plus importante.

Ma suggestion est donc: investir le plus tôt possible dans des supports long terme et ajuster au fur et à mesure de votre progression en termes de connaissance et de taille de votre capital vers des supports de plus en plus avancés.

Dans ce cas, on commence par quoi?

Un support de gestion pilotée: un portefeuille diversifié (actions et obligations), géré par des professionnels, fonction de l’évolution des marchés.

Les critères? coûts et la simplicité de gestion. Ce qui me fait privilégier les gestion pilotée qui utilisent des ETFs, avec des acteurs type Fintech (frais de gestion réduits grâce à l’automatisation) dans des formats fiscalement avantageux.

Qu’est-ce que les ETFs on à voir la dedans?

Frais de gestion plus bas : Les ETFs ont des frais de gestion plus faibles que les FCP (les fonds classiques que vous trouverez notamment dans l’Assurance Vie habituelle), ce qui offre des économies sur le coût total de l’investissement.

Forte diversification : Les ETFs permettent d’investir dans un panier d’actions ou d’obligations très diversifié, couvrant parfois des centaines voire des milliers de titres, ce qui peut offrir une meilleure diversification que les FCP qui ont un portefeuille plus restreint.

Transparence : Les ETFs sont cotés en bourse, ce qui permet d’obtenir des informations en temps réel sur leur valeur liquidative et leur performance.

2 exemples:

– Gestion pilotée robot-advisor Nalo en format Assurance Vie (https://nalo.fr/?idpa=A2FD5 – code promo d’un des lecteurs)

Gestion pilotee Yomoni en format PEA https://www.yomoni.fr/investir/pea

Quel que soit votre niveau de connaissance, je pense qu’avoir un des ces supports est une excellente option par défaut, et qu’elle peut d’ailleurs suffire à beaucoup d’entre nous. Une fois le support de votre choix ouvert (les minimums sont relativement accessibles), n’oubliez pas de mettre en place le virement automatique (puis de l’ajuster ensuite en fonction de vos augmentations de salaire). Mettez en place le virement dès l’ouverture, pas besoin de créer davantage d’excuses pour se mettre en marche.

J’ai déjà mis en place cette première étape et je souhaite aller plus loin

La suite de l’histoire consiste selon moi à prendre davantage d’autonomie dans le choix des sous-jacents et dans la gestion du portefeuille. Pour accéder à ces sous-jacents, certains nouveaux types de comptes vont être introduits (comme les comptes titres).

Un “Compte-titres” est un type de compte d’investissement qui permet d’acheter et de détenir des titres, tels que des actions, des obligations, des ETFs et des fonds communs de placement.

Le compte-titres peut être ouvert auprès d’un courtier en ligne ou d’une banque, et l’investisseur est responsable de la gestion de son propre portefeuille de titres.

Il existe différents types de compte-titres, notamment :

Le compte-titres ordinaire : c’est le compte-titres standard qui permet d’acheter et de détenir des titres en toute liberté, sans limitation sur les types de titres ou les montants investis. Faites un tour sur https://www.degiro.fr/ pour un compte au tarif attractif

Le PEA : le plan d’épargne en actions est un compte-titres destiné aux investissements en actions de sociétés européennes, et qui offre des avantages fiscaux intéressants. Contrairement au compte-titre ordinaire, Le PEA présente des restrictions en termes de sélection des sous-jacents et un plafond maximum. En pratique, le PEA permet quand même de créer un portefeuille mondial grâce aux ETFs. Vous pouvez regarder du côté de Fortuneo pour une solution attractive: https://www.fortuneo.fr/bourse/plan-epargne-actions

Une fois que compte-titre de votre choix mis en place, une bonne piste pour commencer est de vous constituer un portefeuille d’ETF sur mesure, diversifié entre actions et obligations et en fonction des régions, selon votre objectif et votre appétit au risque.

Pour ce qui est des actions, un ETF S&P 500 est la base de votre allocation (des dizaines sont disponibles). Pour les obligations, un ETF diversifié sur les entreprises américaines considérées les moins risquées par les agences de notation, comme le iShares Corp Bond UCITS ETF, peut servir de point de départ.

Les investissements en direct dans des actions et des obligations d’entreprises spécifiques constituent encore une complexité supplémentaire qui n’est pas forcément nécessaire pour atteindre vos objectifs.

L’immobilier

J’ai choisi volontairement de ne pas commencer par l’immobilier dans cet article sur les investissements. C’est un sujet complexe et granulaire dont je n’ai pas l’ambition de faire la synthèse ici. Donc je vais m’en tenir à quelques commentaires sous forme de questions pour vous illustrer l’intérêt de l’immobilier dans mon approche.

L’immobilier est-il une bonne stratégie d’investissement?

La question est trop vague: oui il existe sûrement des investissements immobiliers susceptibles de fonctionner dans votre stratégie. Néanmoins, toute opération immobilière n’est pas une bonne opération, et chaque opération est par nature unique dans ce domaine donc pas la peine de “copier” une opération faite par un proche ou vue sur les réseaux.

Par où commencer?

A mon sens, par une opération locative (en direct ou en SCPI), à crédit, dans un objectif long terme. En fonction de votre intérêt pour le sujet et le temps dont vous bénéficiez, à vous de définir ce qui fonctionne le mieux. Une fois que vous avez fait un choix, mettez-vous au travail pour réaliser votre première opération, même modeste. N’essayez pas de réaliser l’opération parfaite: considérez les premières opérations comme des opportunités d’apprendre, avec des montants raisonnables.

Pourquoi emprunter de l’argent pour réaliser vos opérations immobilières?

1. Profiter de l’effet de levier : L’emprunt permet de bénéficier de l’effet de levier, c’est-à-dire de multiplier le rendement potentiel de l’investissement. Par exemple, si vous empruntez 100 000 € pour acheter un bien immobilier à 300 000 € et que la valeur de ce bien augmente de 10%, votre rendement sera de 30% (10% sur les 300 000 €), soit trois fois plus que si vous aviez payé comptant.

2. Bénéficier d’une fiscalité avantageuse : Les intérêts d’emprunt peuvent être déduits des revenus fonciers, ce qui permet de réduire l’impôt sur les revenus locatifs.

3. Préserver sa trésorerie : Vous pouvez lancer votre projet sans avoir besoin de toucher à votre épargne d’urgence et en conservant votre autres supports d’investissements.

Crowdfunding

Opportunité de taux significativement plus élevés. Soyez attentifs à la nature des projets (si l’entreprise coule, auront-il des actifs à vendre pour récupérer votre argent ou non) et aux risques de fraude (significativement plus élevé dans cette poche d’investissements).

Visitez ANAXAGO afin de vous faire une idee plus precisee: https://www.anaxago.com/crowdfunding-immobilier

Les cryptos

Sujets passionnant et quasi-infini.

Je vois cela comme une démocratisation du “Private Equity” historiquement réservé aux professionnels. Petite probabilité de gagner beaucoup contre forte probabilité de tout perdre. Important donc de limiter la taille de cette poche dans la phase de création de votre capital, mais de plus en plus intéressant au fur et à mesure que votre capital croît.

Intéressez-vous aussi au stacking, notamment sur les stable coins.

L’épargne projets

A mi-chemin entre les deux cas précédents, l’épargne projet doit commencer par être analysée en fonction de l’horizon de temps de l’objectif.

Si l’objectif est court terme, peu d’opportunités de prendre des risques, donc on privilégiera les supports type compte à terme ou dette liquide (fond monétaire).

Si l’objectif est plus long terme, on peut commencer à introduire des risques et s’inspirer des différents supports de l’épargne long terme.

Le compte à terme (CAT) est un produit d’épargne qui permet de placer de l’argent pour une durée déterminée, généralement de quelques mois à quelques années, à un taux d’intérêt fixe et garanti à l’avance. Le principe est simple : vous déposez de l’argent sur un compte bloqué pendant une période déterminée et vous recevez à l’échéance le capital investi ainsi que les intérêts prévus contractuellement.

Un fonds monétaire est un fonds commun de placement qui investit principalement dans des instruments du marché monétaire, tels que des bons du Trésor, des certificats de dépôt, des billets de trésorerie ou des dépôts à terme. Le but principal des fonds monétaires est de préserver le capital investi tout en offrant un rendement modéré.

Ces ETFs sont souvent appelés “ETFs monétaires” ou “ETFs de trésorerie”. Ils investissent généralement dans des titres du marché monétaire à court terme, comme des bons du Trésor, des certificats de dépôt et des billets de trésorerie. Ces ETFs ont pour objectif de fournir un rendement proche des taux d’intérêt du marché monétaire tout en préservant le capital investi. Tout comme les fonds monétaires, les ETFs monétaires sont considérés comme des placements relativement sûrs et liquides, bien qu’ils comportent également un certain risque de perte en capital en cas de fluctuation des taux d’intérêt ou de défaut de l’émetteur de l’instrument du marché monétaire dans lequel l’ETF a investi.